Novo Banco is a Portugese bank that were looking for a design partner to help them to create their vision of what banking should be. I lead the design from concept to the finished experience working closely with devOps and our reserach team to fully understand the market, customer and the middleware the bank was built on.

NB came to us with an extensive brief that cover a lot of the challenges their customers faced. We used this phase of the project to form our early design decisions and to focus our research.

Novo Banco is a Portugese bank that were looking for a design partner to help them to create their vision of what banking should be. I lead the design from concept to the finished experience working closly with devOps and our reserach team to fully understand the market, customer and the middleware the bank was built on.

NB came to us with an extensive brief that cover a lot of the challenges their customers faced. We used this phase of the project to form our early design decisions and to focus our research.

Novo Banco is a Portugese bank that were looking for a design partner to help them to create their vision of what banking should be. I lead the design from concept to the finished experience working closly with devOps and our reserach team to fully understand the market, customer and the middleware the bank was built on.

NB came to us with an extensive brief that cover a lot of the challenges their customers faced. We used this phase of the project to form our early design decisions and to focus our research.

NB's current product didn't match their vision. Over time new feature had been added without any consideration to the overall flow and overall experience which resulted in a product that was outdated, inconsistent and difficult to use.

NB's current product didn't match their vision. Over time new feature had been added without any consideration to the overall flow and overall experience which resulted in a product that was outdated, inconsistent and difficult to use.

We knew the insight from the current app would only take us so far in understanding the customer and their issues. Our initial research looked at what customers wanted from their bank, how they engage with their money and developed a tool to help map customer behaviors.

We took these insights and created a statement of intent, that would help us to frame the goal of the product and give us a reference to fall back to when we needed it.

These are broken down into 3 key questions…

Who - is the customer?

What - are their needs?

Wow - How will we differentiate ourselves?

We knew the insight from the current app would only take us so far in understanding the customer and their issues. Our initial reasearch looked at what customers wanted from their bank, how they engage with their money and developed a tool to help map customer behaviours

We took these insights and created a statement of intent, that would help us to frame the goal of the product and give us a reference to fall back to when we needed it.

These are broken down into 3 key questions…

Who - is the customer?

What - are their needs?

Wow - How will we differentiate ourselves?

To support our vision of what NB could be we created a set of principles that we believe are key to the future of banking. This also worked as a great tool for on-boarding new team members and stakeholders to the product.

To support our vision of what NB could be we created a set of principles that we believe are key to the future of banking. This also worked as a great tool for on-boarding new team members and stakeholders to the product.

To support our vision of what NB could be we created a set of principles that we believe are key to the future of banking. This also worked as a great tool for on-boarding new team members and stakeholders to the product.

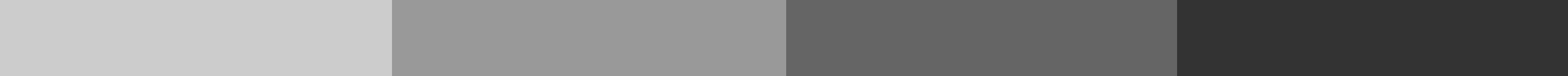

PRODUCT ECOSYSTEM

PRODUCT ECOSYSTEM

PRODUCT ECOSYSTEM

PRODUCT ECOSYSTEM

Creating a product ecosystem around one central hub that powers frictionless experiences across all aspects of the bank.

Creating a product ecosystem around one central hub that powers frictionless experiences across all aspects of the bank.

Creating a product ecosystem around one central hub that powers frictionless experiences across all aspects of the bank.

Creating a product ecosystem around one central hub that powers frictionless experiences across all aspects of the bank.

BUILDING BLOCKS

BUILDING BLOCKS

BUILDING BLOCKS

BUILDING BLOCKS

With modular architecture and a component design library in place, banks can scale and innovate quickly to meet their customer's needs.

With modular architecture and a component design library in place, banks can scale and innovate quickly to meet their customer's needs.

With modular architecture and a component design library in place, banks can scale and innovate quickly to meet their customer's needs.

With modular architecture and a component design library in place, banks can scale and innovate quickly to meet their customer's needs.

OPEN BANKING

OPEN BANKING

OPEN BANKING

OPEN BANKING

Truly open banking will allow customers to access all aspects of their financial life in one location.

Truly open banking will allow customers to access all aspects of their financial life in one location.

Truly open banking will allow customers to access all aspects of their financial life in one location.

Truly open banking will allow customers to access all aspects of their financial life in one location.

MAKE IT PERSONAL

MAKE IT PERSONAL

MAKE IT PERSONAL

MAKE IT PERSONAL

The end goal is to leverage new technologies to create a truly personal experience for customers.

The end goal is to leverage new technologies to create a truly personal experience for customers.

The end goal is to leverage new technologies to create a truly personal experience for customers.

Design principles in action

Design principles

in action

Armed with our design principles we set out to create our vision for NB. In our discovery phase, we looked at what an MVP might look like well as what developing what the future of the bank could be.

Armed with our design principles we set out to create our vision for NB. In our discovery phase, we looked at what an MVP might look like well as what developing what the future of the bank could be.

Armed with our design principles we set out to create our vision for NB. In our discovery phase, we looked at what an MVP might look like well as what developing what the future of the bank could be.

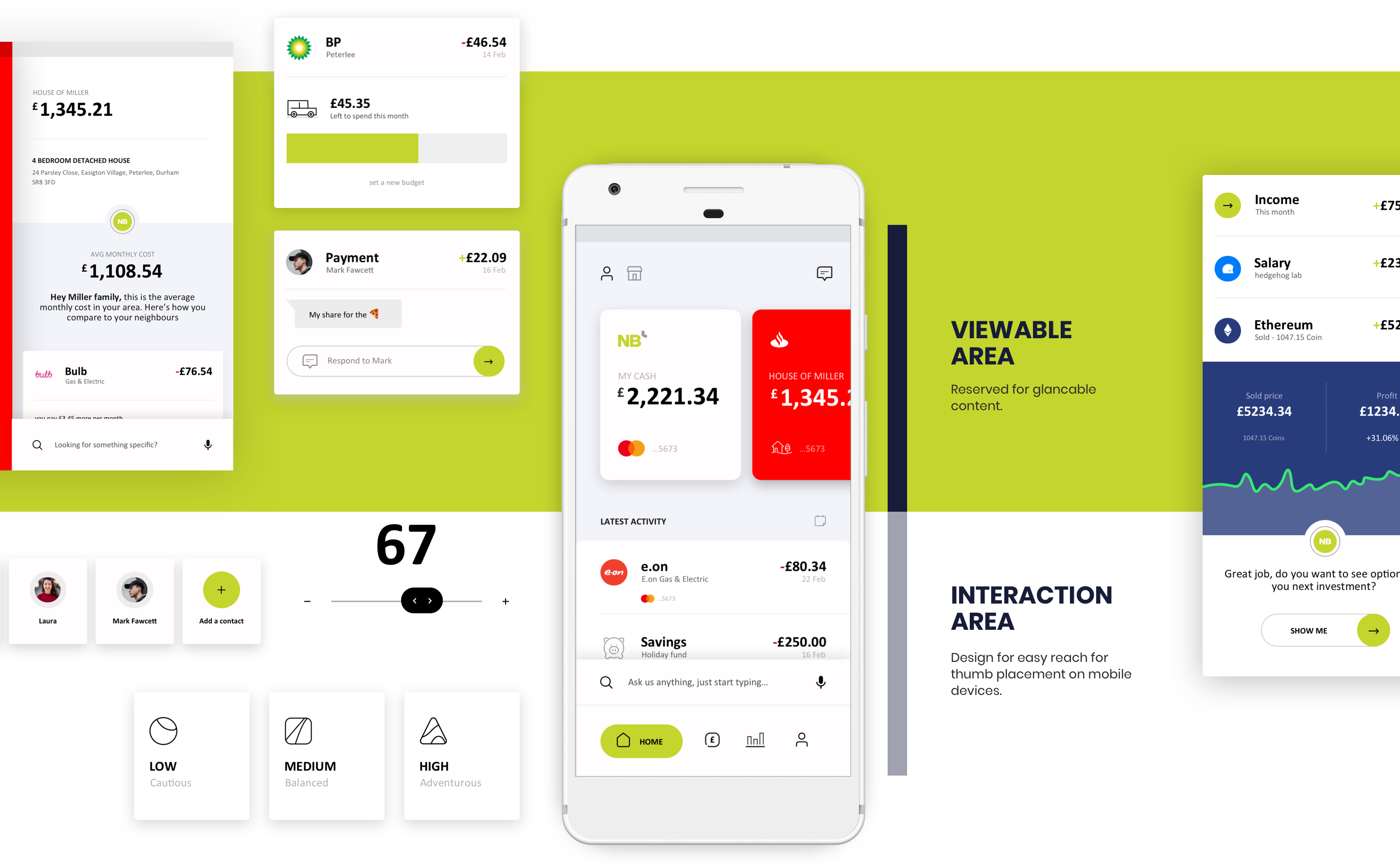

Product

Ecosystem

Product

Ecosystem

Customers were becoming increasingly frustrated navigating the various touchpoints across NBs services. As the bank increased its services, new bits of functionality had been added without taking into consideration the journey for the customer.

This lead to a very disjointed experience when applying for a loan or opening a new account

Rather than creating digital business functions for each channel, it makes sense to do everything once, and disperse to all channels through a central hub.

Customers were becoming increasingly frustrated navigating the various touchpoints across NBs services. As the bank increased its services, new bits of functionality had been added without taking into consideration the journey for the customer.

This lead to a very disjointed experience when applying for a loan or opening a new account

Rather than creating digital business functions for each channel, it makes sense to do everything once, and disperse to all channels through a central hub.

The building blocks

With a modular architecture and a component-driven design library in place, NB could innovate and roll out new features without the dependencies of the past. A modular architecture empowers NB to go beyond responding to market realities, to actively creating them in conjunction with the customer.

With a modular architecture and a component-driven design library in place, NB could innovate and roll out new features without the dependencies of the past. A modular architecture empowers NB to go beyond responding to market realities, to actively creating them in conjunction with the customer.

Open Banking

PSD2 and open banking have been on my the radar since my time at Atom Bank so this felt like a perfect time to apply what I learned there to create a truly open banking experience.

PSD2 and open banking have been my the radar since my time at Atom Bank so this felt like a perfect time to apply what I learnt there to create a truly open banking experience.

Making it personal

The end goal is to leverage big data to create more efficient operations, higher profits and happier customers. This would move away from the one-size-fits-all to a customer-focused approach that is tailored to their individual needs.

The end goal is to leverage big data to create more efficient operations, higher profits and happier customers. This would move away from the one-size-fits-all to a customer-focused approach that is tailored to their individual needs.

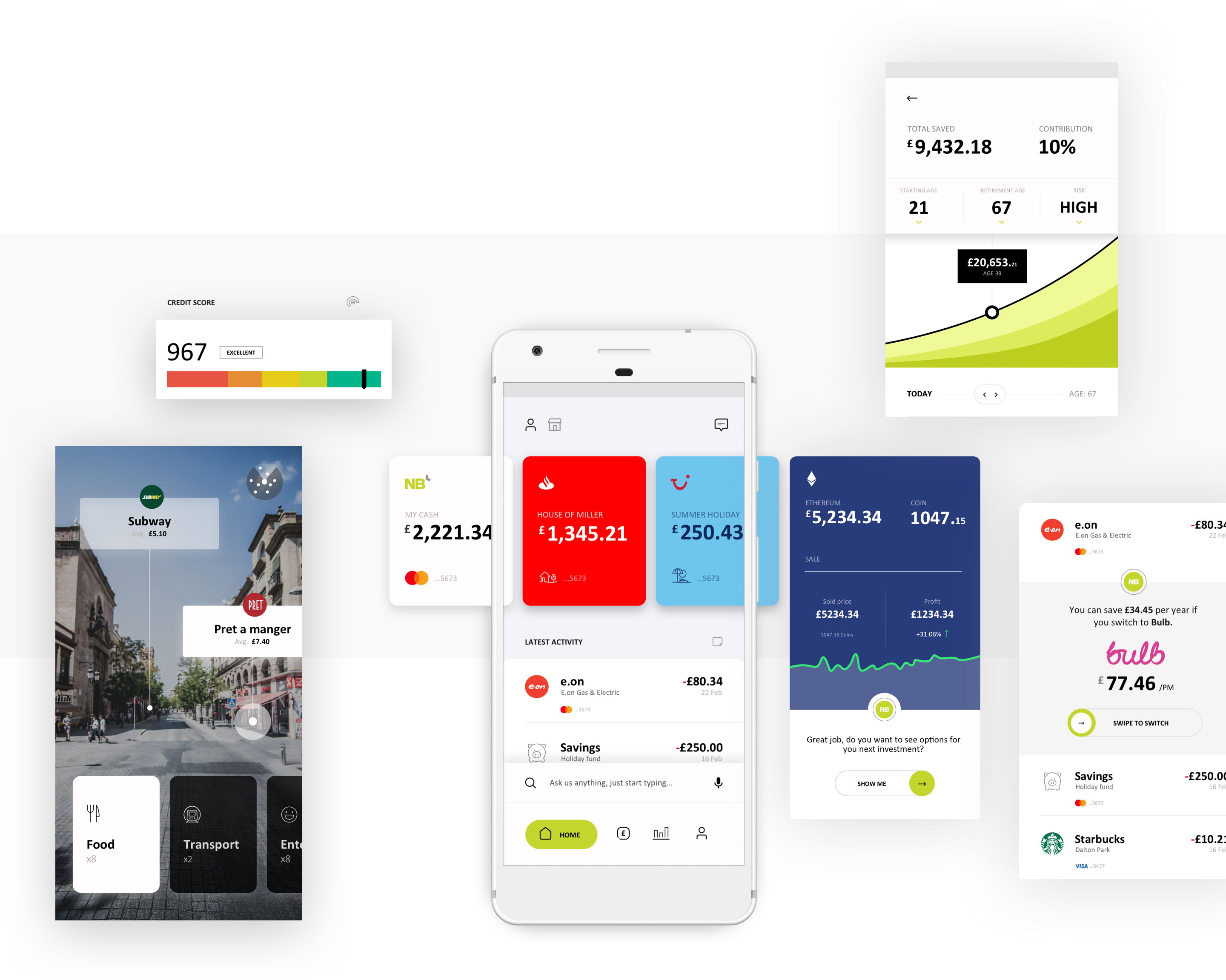

This initial phase was all about getting NB's key stakeholders excited about the vision for the product. Once we had buy in we set about creating a product roadmap to turn that vision into a reality, below is a high-level view of that roadmap

This initial phase was all about getting NB's key stakeholders excited about the vision for the product. Once we had buy in we set about creating a product roadmap to turn that vision into a reality, below is a high-level view of that roadmap

#1

#1

Plan version 1 keeping the feature list small and focused so we can quickly and easily test our assumptions with customers before we roll out the product at scale.

Plan version 1 keeping the feature list small and focused so we can quickly and easily test our assumptions with customers before we roll out the product at scale.

Plan version 1 keeping the feature list small and focused so we can quickly and easily test our assumptions with customers before we roll out the product at scale.

Plan version 1 keeping the feature list small and focused so we can quickly and easily test our assumptions with customers before we roll out the product at scale.

#2

#2

Analyse the feedback and engagement from early adopters, and make improvements to version 1 where needed. Develop the full bank across mobile technologies.

Analyse the feedback and engagement from early adopters, and make improvements to version 1 where needed. Develop the full bank across mobile technologies.

Analyse the feedback and engagement from early adopters, and make improvements to version 1 where needed. Develop the full bank across mobile technologies.

Analyse the feedback and engagement from early adopters, and make improvements to version 1 where needed. Develop the full bank across mobile technologies.

#3

#3

Create a product roadmap across all platforms keeping in mind platform OS release cycles and what new technology and customer behaviors that will impact the roadmap.

Create a product roadmap across all platforms keeping in mind platform OS release cycles and what new technology and customer behaviours that will impact the roadmap.

Create a product roadmap across all platforms keeping in mind platform OS release cycles and what new technology and customer behaviours that will impact the roadmap.

Create a product roadmap across all platforms keeping in mind platform OS release cycles and what new technology and customer behaviors that will impact the roadmap.